Unlock Exclusive Benefits With a Federal Credit Score Union

Federal Lending institution supply a host of exclusive advantages that can considerably influence your economic wellness. From improved savings and checking accounts to reduced rates of interest on fundings and individualized financial preparation solutions, the benefits are customized to help you conserve money and accomplish your financial objectives a lot more successfully. But there's even more to these advantages than just monetary advantages; they can likewise give a complacency and neighborhood that goes past standard banking services. As we explore additionally, you'll discover exactly how these distinct advantages can really make a distinction in your monetary trip.

Subscription Eligibility Standards

To become a participant of a federal lending institution, people need to satisfy details qualification standards developed by the institution. These criteria vary relying on the specific credit union, however they commonly include variables such as geographic area, work in a specific sector or company, membership in a specific organization or association, or household relationships to present members. Federal cooperative credit union are member-owned financial cooperatives, so eligibility needs remain in area to ensure that people that sign up with share a common bond or association.

Improved Cost Savings and Checking Accounts

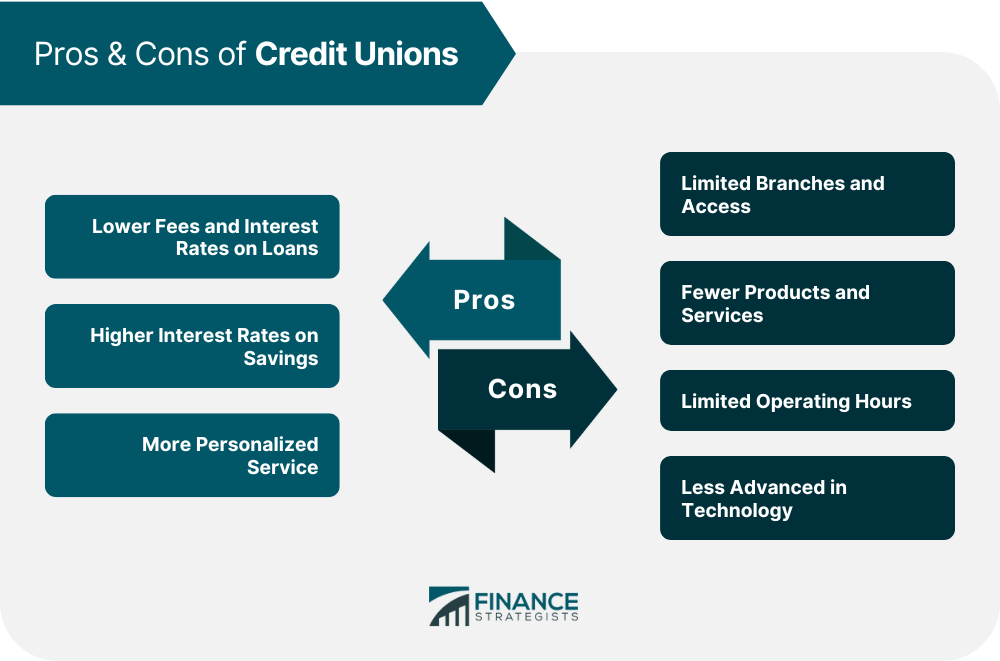

With boosted cost savings and inspecting accounts, government cooperative credit union supply members premium monetary products designed to optimize their money administration methods. These accounts often come with greater rate of interest on financial savings, reduced costs, and added advantages compared to traditional banks. Participants can delight in functions such as affordable dividend rates on interest-bearing accounts, which assist their money grow faster over time. Inspecting accounts may offer advantages like no minimum balance demands, cost-free checks, and ATM fee repayments. In addition, government lending institution typically provide online and mobile banking solutions that make it hassle-free for participants to check their accounts, transfer funds, and pay expenses anytime, anywhere. By making use of these enhanced cost savings and examining accounts, participants can maximize their financial savings potential and successfully manage their daily funds. This focus on offering premium economic items establishes government credit history unions apart and demonstrates their commitment to aiding members achieve their financial objectives.

Lower Rate Of Interest on Finances

Federal cooperative credit union supply members with the benefit of reduced rates of interest on car loans, allowing them to borrow cash at even more budget friendly terms compared to other monetary establishments. This benefit can lead to significant savings over the life of a loan. Reduced rate of interest imply that borrowers pay much less in passion fees, reducing the overall cost of borrowing. Whether participants require a financing for an automobile, home, or personal expenditures, accessing funds with a federal credit history union can bring about extra beneficial repayment terms.

Personalized Financial Planning Solutions

Given the focus on improving members' economic well-being with lower interest rates on financings, federal credit score unions also use individualized monetary planning services to aid individuals in attaining their lasting financial objectives. By evaluating revenue, expenditures, liabilities, and possessions, government credit report go to this site union monetary planners can help members develop a comprehensive monetary roadmap.

Furthermore, the customized financial preparation services provided by government credit scores unions frequently come with a lower expense compared to exclusive monetary consultants, making them much more obtainable to a larger range of people. Members can profit from specialist support and knowledge without incurring high fees, lining up with the credit score union viewpoint of focusing on members' economic well-being. Generally, these solutions goal to equip participants to make enlightened monetary decisions, develop riches, and protect their financial futures.

Accessibility to Exclusive Member Discounts

Members of federal lending institution appreciate unique accessibility to a variety of participant discounts on numerous services and products. Wyoming Federal Credit Union. These discount rates are an important perk that can help participants save money on everyday expenses and special purchases. Federal cooperative credit union frequently companion with sellers, service providers, and various other companies to provide discounts specifically to their participants

Members can benefit from discount rates on a range of items, consisting of electronic devices, garments, travel bundles, and extra. Additionally, solutions such as cars and truck rentals, resort reservations, and home entertainment tickets might also be readily available at reduced prices for lending Website institution members. These special discounts can make a substantial distinction in members' budget plans, permitting them to appreciate financial savings on both crucial products and luxuries.

Verdict

In verdict, signing up with a Federal Lending institution supplies many advantages, including enhanced financial savings and examining accounts, lower rate of interest on fundings, personalized monetary preparation solutions, and accessibility to exclusive member price cuts. By coming to be a participant, people can benefit from a series of financial perks and services that can aid them conserve cash, prepare for the future, and enhance their connections to the regional community.